Travel Insurance with Tata AIG Group Overseas Travel Guard

CruiseBay is proud to provide Tata AIG Group Overseas Travel Guard where our cruise guests get a pre-cruise trip cancellation cover as well as other benefits.

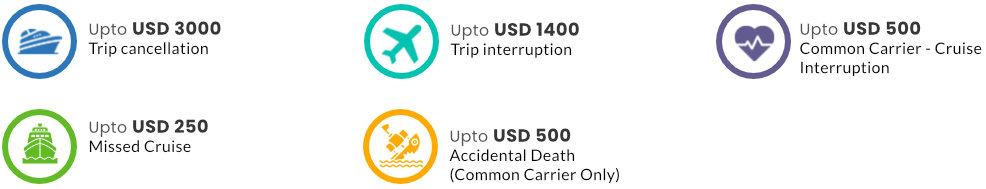

The highlight coverages with the sum insured of the TATA AIG overseas travel insurance cover for our CruiseBay guests include:

This is primarily a pre-cruise trip cancellation cover that comes into effect if you have to cancel your cruise booking prior to travel due to unforseen circumstances. This cover will have to supplemented with an Accident and Medical Insurance cover for your overseas travel.

Summary of Coverages with limits for guests upto 80 years

|

Coverages |

Sum Insured |

Deductible Opted |

|

|

USD |

USD |

|

Common Carrier – Cruise Interruption |

$ 500.00 |

$ 0.00 |

|

Missed Cruise |

$ 250.00 |

$ 0.00 |

|

Trip Cancellation |

$ 3,000.00 |

$ 0.00 |

|

Trip Interruption |

$ 1,400.00 |

$ 0.00 |

|

Accidental Death(Common Carrier Only) |

$ 500.00 |

$ 0.00 |

Premium Payable

|

|

Premium Payable (INR)

US / Canada |

Premium Payable (INR)

NON US / Canada |

|

For guests upto 80 years: |

|

Per Person Per Day Premium (Including GST) |

227 |

198 |

Coverage Terms and Conditions

-

Aggregate Limit (Per incident) for Accidental Death is $ 2500

-

Maximum Trip Duration is 45 days per person per trip

-

The overseas cruise travel insurance policy has been the issued at the time of making the final payment for the cruise booking (usually 75 to 90 days prior to the cruise)

-

The coverage starts from the time the person leaves the Indian Soil by Air / Ship

-

The insurance will be valid from when the insured boards the common carrier from India to start the overseas cruise journey until their return back to India.

-

Any Policy / Certificate of Insurance is non-refundable after the commencement of trip or if any claim has been lodged under such Policy / Certificate of insurance, premium shall not be refunded in case of any claims being paid under the policy.

-

Any E-voucher, Credit shell or any other Coupon received on the account of Trip cancellation from the Service Provider will be considered as refunded portion

-

Any Policy/Certificate of Insurance are non refundable after the commencement of trip or if any claim has been lodged under such Policy/Certificate of insurance

-

Premium shall not be refunded in case of any claims being paid under the policy

-

Any change in GST/applicable taxes might change the premium

For queries related to CruiseBay’s overseas cruise travel insurance policy,

please call us at 020-66442999 OR mail us at info@cruisebay.in